Flexible funding for PayPoint retailers

YouLend, an alternative business finance company, is working with PayPoint to provide eligible PayPoint card payment retailers with fast and flexible funding offers.* This type of funding can help retailers focus on growth, whether it’s creating new jobs, investing in new projects, buying stock or simply boosting cash flow.

*Eligibility criteria will apply – only available to existing PayPoint merchants receiving acquiring services from an acquiring provider organised through PayPoint who have not entered into any other agreement with third parties for the sale of their receivables. If you do not receive acquiring services organised through PayPoint, an alternative may be available. Business must be trading for 3 months or more, with a minimum of £1,500 in card transactions per month.

The benefits

Apply online in minutes

Fast decision

Only pay back as you earn

Track your repayments online

No hidden fees or monthly charges

Easy to renew

By clicking here you will be re-directed to YouLend’s website to complete your application.

How does it work?

It’s totally flexible.

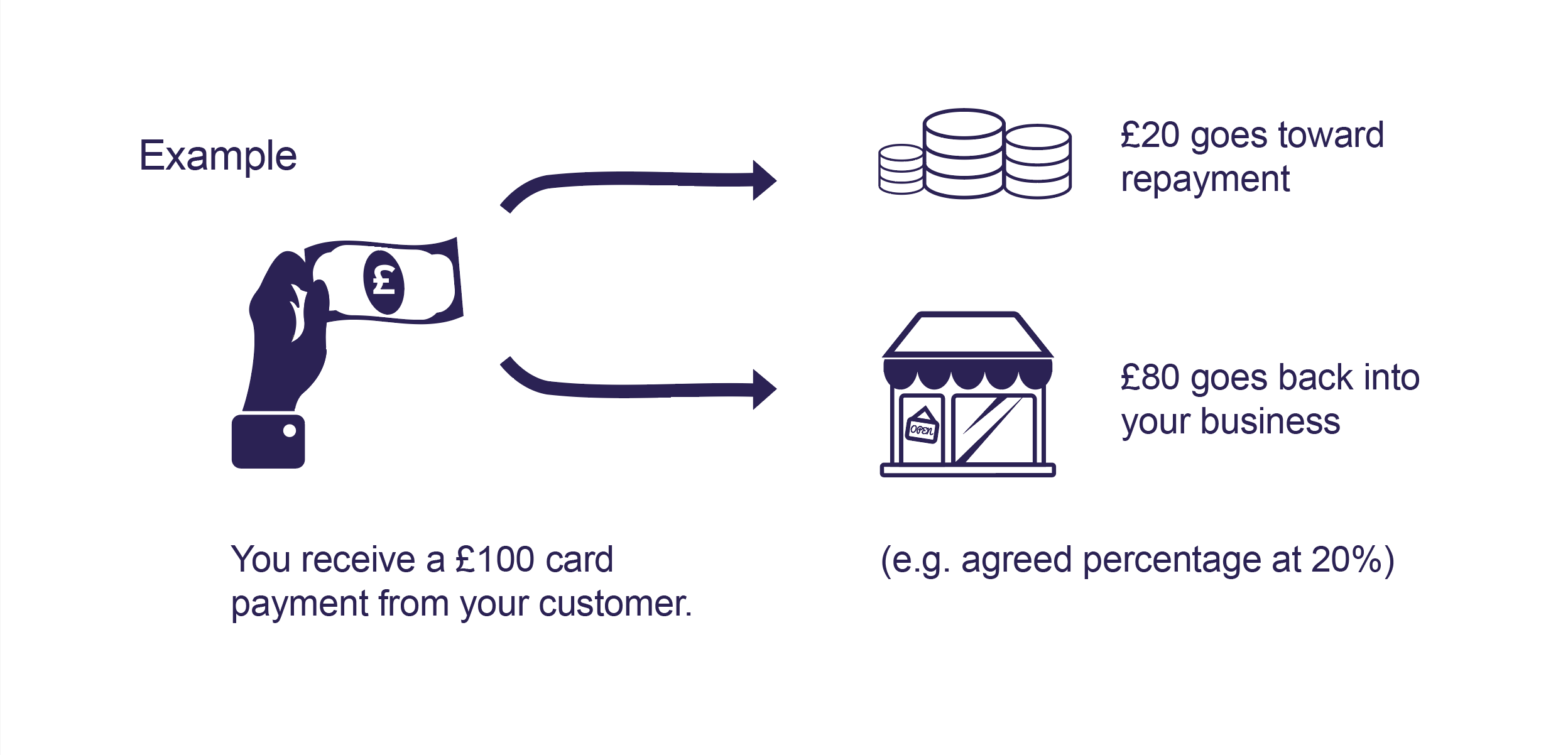

Your business funding is repaid by a small amount each time you take a card payment from your customers, giving you the added peace of mind that there are no fixed monthly repayments to make.

When a customer pays by card, a fixed percentage of that transaction is used to repay your funding. This percentage stays the same regardless of the transaction value, so you’ll always repay proportionately with your income from card sales.

For more specific product information, see the Product Explanation below.

To find out more, call 0203 924 9983 or email [email protected]

All Cash Advance and Loan Advance applications are processed by our dedicated provider, Youlend Limited T/A Youlend.

Product Explanation: Two types of financing products are provided. 1) Cash Advance: This is a transaction whereby the merchant sells, and the purchaser purchases a specified portion of the merchant’s current and future card receivables through a sale and purchase agreement in consideration of a purchase price paid to the merchant. The sold card receivables are collected through an agreed fixed percentage of the merchant’s card takings. This is a sale of receivables only, not a loan.

2) Loan Advance: This is an unsecured amortising loan with a fixed maturity date. The loan is repaid (amortised) through the greater of (1) an amount equating to an agreed fixed percentage of the merchant’s card takings, and (2) a weekly minimum amount. This loan product is only available to incorporated entities (private limited companies, public limited companies, limited partnerships and partnerships where 2/3 of all partners are incorporated entities also known as body corporates). Any credit to be provided to a merchant as borrower is to be applied for business purposes relating to the merchant only and not for the benefit of any other person; The merchant borrower is being made aware that the loan agreement entered into by the merchant borrower will not be subject to the regulation and legal protections applicable to loans that are consumer credit or regulated mortgage contracts.

Part of the PayPoint loyalty programme. PayPoint’s activities in relation to the YouLend products do not constitute regulated credit broking.